Updated on March 21, 2016 with the 2014 research:

Who is your target market? Often when I ask clients that question, they reply with “All wine drinkers.” The problem with that thought process is that there are six different segments inside the wine drinking population. Paying attention to who exactly your customers are, will help you create marketing campaigns that precisely target your niche.

For example, if your top wine buyers are “Image Seekers” they will check restaurant wine lists before they dine out so they can research wine scores online. If you want to appeal to this audience, make sure you reference outside reviews and wine scores on your website. Plus, know that Image Seekers are greatly influenced by packaging and design.

If your wine buyers are “Overwhelmed” they find the entire wine buying process confusing. If this is your ideal target market, make more promotional materials to describe your wine and what it pairs with. Have in-store tastings to better reach out to these overwhelmed consumers.

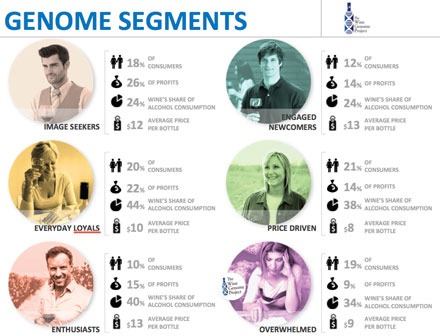

At a few of the presentations that I gave the last few months in Texas, Illinois and Pennsylvania, I mentioned that the original research published in 2008 was updated in 2014 to the following 6 wine consumers:

1. Overwhelmed

- By number of choices

- Like to drink wine, but don’t know what to buy

- May select by wine label design

- Want easy to understand info in retail

- Open to advice, but frustrated if no one is in the wine section to help

- If confused, won’t buy anything

2. Image Seekers

- Status symbol

- Are just discovering wine

- Have basic wine knowledge

- Like to be the first to try new wine

- Open to innovative packaging

- Prefer Merlot

- Check restaurant wine lists online and research scores

- Millennials and Males

3. Enthusiast

- Entertain at home with friends

- Consider themselves knowledgeable about wine

- Like to browse wine sections at stores

- Live in cosmopolitan centers, affluent suburban spreads or country setting

- Influenced by wine ratings and scores

- 47% buy wine in 1.5L as “everyday wine” to supplement their “weekend wine”

4. Everyday Loyal

- Like wine from established wineries

- Prefer to entertain at home

- Wine makes occasion more formal

- When I find a brand I like, I stick with it

- Wine is part of my regular routine

5. Price Driven

- I believe you can buy good wine without spending a lot

- Price is top consideration

- Shop in a variety of stores to find the best deals

- Use coupons & know what’s on sale ahead of time

- Typically buy a glass of the house wine when dining out, due to the value

6. Engaged Newcomers

- Don’t know much about wine, just like to drink it

- Young = Millennials

- Wine is part of socializing

- Interested in learning more about wine

The original 2008 research:

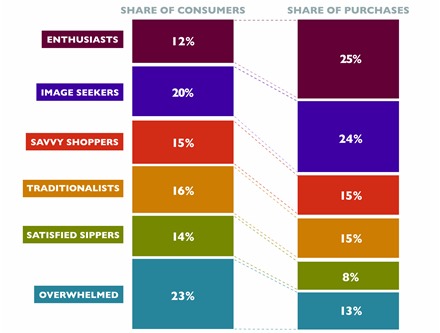

According to Wines and Vines, Constellation, the world’s largest wine seller did a study in 2008 called Project Genome surveying the “purchases of 10,000 premium-wine consumers–defined as those who purchased wine priced at $5 and higher–over an 18-month period. While the first Project Genome study asked online survey participants to recall their wine purchases during the last 30 days, the Home & Habits study tracked the actual purchases of Nielsen Co.’s Homescan® consumer purchase panel, which employs in-home bar code scanners and surveys to map consumer buying behavior across a demographically balance.”

While this study is 5 years old, I think it is still relevant to 2013’s consumers due to the quantity of consumers that were involved in the Project Genome. Plus, since it tracked actual purchases, not just what people remembered. Here is a breakdown of the 6 types of wine buyers: Enthusiasts, Image Seekers, Savvy Shoppers, Traditionalists, Satisfied Sippers and Overwhelmed.

Overwhelmed (23% of consumers):

- Overwhelmed by sheer volume of choices on store shelves

- Like to drink wine, but don’t know what kind to buy and may select by label

- Looking for wine information in retail settings that’s easy to understand

- Very open to advice, but frustrated when there is no one in the wine section to help

- If information is confusing, they won’t buy anything at all.

Image Seekers (20% of consumers):

- View wine as a status symbol

- Are just discovering wine and have a basic knowledge of it

- Like to be the first to try a new wine, and are open to innovative packaging

- Prefer Merlot as their No. 1 most-purchased variety; despite “Sideways,” Pinot Noir is not high on their list

- Use the Internet as key information source, including checking restaurant wine lists before they dine out so they can research scores

- Millennials and males often fall into this category.

Traditionalists (16% of consumers):

- Enjoy wines from established wineries

- Think wine makes an occasion more formal, and prefer entertaining friends and family at home to going out

- Like to be offered a wide variety of well known national brands

- Won’t often try new wine brands

- Shop at retail locations that make it easy to find favorite brands.

The Savy Shoppers (16% of consumers):

- Enjoy shopping for wine and discovering new varietals on their own

- Have a few favorite wines to supplement new discoveries

- Shop in a variety of stores each week to find best deals, and like specials and discounts

- Are heavy coupon users, and know what’s on sale before they walk into a store

- Typically buy a glass of the house wine when dining out, due to the value.

Satisfied Sippers (14% of consumers):

- Don’t know much about wine, just know what they like to drink

- Typically buy the same brand–usually domestic–and consider wine an everyday beverage

- Don’t enjoy the wine-buying experience, so buy 1.5L bottles to have more wine on hand

- Second-largest category of warehouse shoppers, buying 16% of their wine in club stores

- Don’t worry about wine and food pairing

- Don’t dine out often, but likely to order the house wine when they do.

Wine Enthusiasts (12% of consumers):

- Entertain at home with friends, and consider themselves knowledgeable about wine

- Live in cosmopolitan centers, affluent suburban spreads or comfortable country settings

- Like to browse the wine section, publications, and are influenced by wine ratings and reviews

- 47% buy wine in 1.5L size as “everyday wine” to supplement their “weekend wine”

- 98% buy wine over $6 per bottle, which accounts for 56% of what they buy on a volume basis.

Now that you have read all 6 different types of wine buyers, which ones describe your customers? Once you have nailed down which of these buyers is your ideal client, you can create strategies to appeal specifically to your niche.